ETH Price Prediction: Navigating the $4,000 Battlefield

#ETH

- Technical Resistance: ETH must overcome the 20-day MA at $4,371 to initiate a meaningful recovery

- Institutional Mixed Signals: While SWIFT adoption is positive, large ETF outflows create near-term pressure

- Support Levels Critical: The $3,911 Bollinger Band lower boundary represents make-or-break support for short-term direction

ETH Price Prediction

ETH Technical Analysis: Bearish Signals Dominate Short-Term Outlook

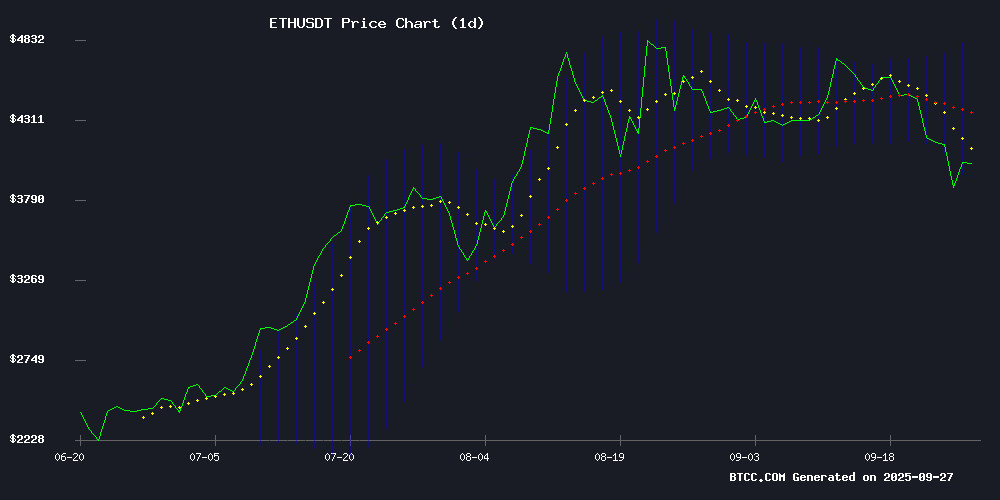

ETH is currently trading at $3,999.08, significantly below its 20-day moving average of $4,371.34, indicating bearish momentum. The MACD shows a reading of 153.56 versus 27.26, with a difference of 126.30, suggesting continued downward pressure. Bollinger Bands position the current price NEAR the lower band at $3,911.70, with the middle band at $4,371.34 and upper band at $4,830.98. According to BTCC financial analyst Ava, 'The technical picture shows ETH struggling to maintain the $4,000 level, with key resistance at the 20-day MA around $4,371. A break below the lower Bollinger Band could trigger further declines toward $3,500.'

Mixed Fundamentals Create Uncertainty for ETH Recovery

Recent developments present a complex landscape for Ethereum. Positive news includes SWIFT testing ethereum Layer 2 for stablecoin payments and record accumulation amid open interest reset. However, concerning factors include BlackRock and Fidelity selling $274M ETH, potential downthrust to $3.5K, and HyperVault's suspected $3.6M rug pull. BTCC financial analyst Ava notes, 'While institutional adoption continues with SWIFT's involvement, the large institutional selling and fragile $4,000 recovery suggest near-term headwinds. The multi-year low in on-exchange holdings indicates long-term confidence but doesn't prevent short-term volatility.'

Factors Influencing ETH's Price

Ethereum Testnet Launch and Price Outlook Amid Fusaka Upgrade

Ethereum has unveiled its new Nimbus testnet ahead of the anticipated Fusaka Upgrade, marking a critical step in the network's evolution. The Nimbus client, a key component of Ethereum's proof-of-stake consensus layer, is now open for testing across the Hoodi, Sepolia, and Holesky testnets. With the Holesky testnet set to conclude by September 2025, Hoodi will take over validator testing duties.

The Fusaka hard fork, slated for November barring network issues, could catalyze Ethereum's price trajectory. Historical precedent suggests successful upgrades often propel ETH higher—this time, the $5,000 threshold appears within reach. After rebounding from a seven-day slump, ETH now hovers above $4,000, with analysts eyeing $4,100 this weekend. Despite a 23% retreat from its all-time high four weeks ago, bullish projections abound. Javon Marks forecasts a parabolic rally toward $8,000, while BitMine CEO Tom Lee underscores Ethereum's robust growth potential for the year.

Vitalik Buterin Criticizes EU's Chat Control Regulation as Threat to Digital Privacy

Ethereum co-founder Vitalik Buterin has issued a stark warning against the EU's proposed Chat Control regulation, arguing it undermines fundamental digital privacy rights. The controversial measure WOULD force messaging platforms—including encrypted services—to scan all user content for potential child exploitation material.

Buterin contends such surveillance mechanisms, while framed as protective measures, ultimately weaken societal security. "You cannot make society secure by making people insecure," he asserted, emphasizing the importance of maintaining private communications without government-mandated backdoors.

The blockchain pioneer advocates for alternative safety improvements through conventional policing methods rather than mass interception of digital communications. He highlighted the inherent risks of creating centralized surveillance databases, noting their vulnerability to hacking attempts by both criminals and state actors.

ETH Risks Further Downthrust to $3.5K as Key Support Wavers

Ether teeters near critical support levels after breaking its ascending channel, with traders eyeing the $3,500 threshold as a potential downside target. The second-largest cryptocurrency by market cap now faces its sternest test since August, with the $4,000 level serving as both psychological support and a technical inflection point.

On-chain metrics paint a conflicted picture—while the RSI's rebound from oversold territory suggests localized accumulation, the breach of the 100-day moving average NEAR $3,800 signals weakening momentum. The daily chart's breakdown below its trendline support confirms bears have gained tactical advantage, though higher timeframe bulls remain undefeated.

Short-term traders note a promising bounce from the $3,850 demand zone on 4-hour charts, but market structure won't turn bullish until ETH reclaims $4,200 resistance. Veteran chartists whisper about 2018-style fractal patterns, where similar breakdowns preceded 40% cascades before resuming macro uptrends.

Ethereum’s Fragile $4,000 Recovery Faces Institutional Headwinds

Ethereum's recent climb back above $4,000 appears precarious as on-chain data reveals sustained bearish pressure. Institutional investors are retreating, with spot ETH ETFs recording $796 million in net outflows this week—pushing month-to-date withdrawals to $388 million. Should this trend persist, September would mark the first net outflow month for these funds since March.

The weakening appetite among large players coincides with deteriorating sentiment from long-term holders. Ethereum's Liveliness metric, measuring the movement of dormant tokens, has surged to a year-to-date high of 0.70 according to Glassnode. This suggests veteran investors are increasingly liquidating positions, casting doubt on ETH's ability to sustain its current valuation.

While broader crypto market sentiment shows improvement, these fundamental indicators paint a cautionary picture. The confluence of institutional exits and long-term holder distribution creates formidable resistance for Ethereum's price recovery.

BlackRock and Fidelity Sold $274M ETH: Rebalancing or Panic Sell?

Institutional crypto transactions are under scrutiny as BlackRock and Fidelity reportedly offloaded $274.4 million worth of Ethereum. The move has sparked debate among traders, with interpretations ranging from cautious portfolio rebalancing to potential panic selling.

Ethereum's market dynamics remain resilient despite the large-scale divestment. The sale highlights growing institutional participation in crypto markets, even as strategies diverge.

Ethereum Whale Awakens After 8 Years, Moves $800M in ETH to Staking

A long-dormant ethereum holder has resurfaced, transferring 200,000 ETH ($800 million) to staking services after eight years of inactivity. The entity controls 736,316 ETH ($2.89 billion) across eight wallets, making this one of the largest reactivations by an early-era investor.

Blockchain analysts note the funds were routed to Ethereum's Plasma infrastructure rather than exchanges—a MOVE interpreted as bullish conviction. "This isn't profit-taking; it's a long-term bet on Ethereum's yield infrastructure," said Emmett Gallic, an on-chain researcher who tracked the wallets.

Transaction histories reveal the ETH originated primarily from Bitfinex, with some addresses untouched since 2017. The staking deployment coincides with growing institutional interest in Ethereum's proof-of-stake rewards mechanism.

Ethereum Investors Realize $800 Million in Profits Amid Market Correction

Ethereum's market dynamics shifted sharply as investors locked in approximately $800 million in profits on Friday, according to Santiment data. The move followed a dip below the $4,000 threshold—ETH's first in over a month—triggering a wave of long liquidations totaling $892 million across Tuesday and Thursday.

Open interest contracted significantly as Leveraged positions unwound, particularly on Binance where over $4 billion in bets evaporated this week. The reset marks one of the most pronounced deleveraging events since January, cooling what had become an overheated derivatives market.

Despite the pullback, Ethereum found support at the 100-day moving average near $3,800. Traders now watch the $4,000 level as a key psychological battleground, with the network's underlying fundamentals remaining strong amid the price volatility.

HyperVault's Suspected $3.6 Million Rug Pull Alerts DeFi Community

Decentralized finance protocol HyperVault is under scrutiny after on-chain analytics firm PeckShield flagged an abnormal outflow of $3.6 million in funds. The assets were bridged from Hyperliquid to Ethereum, converted to ETH, and funneled through Tornado Cash—a mixer notorious for obscuring illicit transactions.

Stolen tokens include $191,494 in UPUMP, $107,358 in USDC, and $1.55 million in WHYPE. HyperVault's abrupt social media deactivation all but confirms the rug pull, a scam where developers drain liquidity and abandon projects. The protocol had offered auto-compounding vaults and keeper-bot harvests, tools now weaponized against users.

SWIFT Tests Ethereum Layer 2 for Stablecoin Payments with Major Banks

SWIFT, the global financial messaging network, is piloting blockchain-based payments using Consensys' Ethereum LAYER 2 solution Linea. The trial involves over a dozen institutions including BNP Paribas and BNY Mellon, exploring stablecoin-like settlement tokens.

The initiative marks a strategic shift for SWIFT, which traditionally facilitates interbank messaging rather than direct settlement. By testing on-chain transactions, the cooperative signals growing institutional acceptance of blockchain infrastructure for cross-border payments.

Linea's selection underscores Ethereum's dominance in enterprise blockchain adoption. The L2 solution offers scalability while maintaining Ethereum's security - a critical factor for financial institutions handling high-value transactions.

Ethereum On-Exchange Holdings Hit Multi-Year Low Amid Market Downturn

Ethereum's exchange reserves have plummeted to their lowest level in years, with just 14.8 million ETH remaining on centralized platforms—a 20% decline since July. This exodus of ETH from exchanges signals a growing preference for self-custody among investors, even as prices falter below $4,000.

The trend suggests tightening supply dynamics, potentially amplifying future price volatility. Coin Bureau data reveals a stark divergence: while bearish sentiment dominates trading activity, long-term holders appear to be accumulating ETH off-exchange, betting on its post-downturn trajectory.

Ethereum Sees Record Accumulation Amid Open Interest Reset

Ethereum's market dynamics are painting a complex picture. Long-term holders and institutional entities have accumulated over 1.2 million ETH in recent weeks, with a notable 400,000 ETH added on September 25 alone. This surge in accumulation, the highest in Ethereum's history, suggests strong conviction among buyers who appear to be positioning for sustained exposure rather than short-term gains.

Meanwhile, the derivatives market has undergone a significant reset, with over $5 billion in Open Interest wiped out. This liquidation of leverage positions could create a healthier foundation for ETH's price action moving forward. The timing coincides with growing anticipation around potential Ethereum ETF approvals, which may be driving institutional accumulation.

The simultaneous occurrence of record accumulation and derivatives market contraction presents an intriguing scenario. While the massive ETH purchases indicate long-term bullish sentiment, the Open Interest reset removes speculative froth from the market. This combination could set the stage for more stable price appreciation, though volatility may persist in the short term as the market finds its new equilibrium.

How High Will ETH Price Go?

Based on current technical and fundamental factors, ETH faces significant resistance around the $4,371 level (20-day MA) with potential for further decline if $3,911 support fails.

| Scenario | Price Target | Probability | Key Levels |

|---|---|---|---|

| Bullish | $4,800-$5,000 | 25% | Break above $4,371 |

| Neutral | $3,900-$4,300 | 40% | Hold $3,911 support |

| Bearish | $3,500-$3,800 | 35% | Break below $3,911 |

BTCC financial analyst Ava suggests: 'The path to higher prices requires reclaiming the 20-day MA at $4,371. Until then, traders should watch the $3,911 support level closely. Institutional developments provide long-term optimism, but technical indicators favor caution in the coming weeks.'